[rev_slider alias="News"]

Winston Gold continues to expand Block 93 and Parallel Veins. High-grade assays include 4 ft. averaging 25.85 g/t gold

CANADIAN SECURITIES EXCHANGE: WGC Immediate Release

WINNIPEG, MANITOBA – September 27th 2018 – Winston Gold Corp. (“Winston Gold” or the “Corporation”) (CSE: WGC) (OTCQB: WGMCF) is pleased to announce that results from a 7-hole drill program (700 metres), have once again extended the Block 93 and Parallel veins on the Company’s wholly-owned Winston Gold Property, near Helena Montana.

“These drill results continue to expand the size and continuity of both the Parallel and Block 93 veins towards the Southwest,” commented Murray Nye, CEO and Director of Winston Gold Mining. “These holes have increased the length of the Parallel Vein by 125 ft (38.1 m) to a strike length of 583 ft. (178 m). The Block 93 Vein has been increased by 103 ft (31.4 m) to a strike length of 417 ft. (127 m). The vertical extent of the Block 93 vein has also been extended by 43 ft. (13 m) to 240 ft. (73 m). Both veins remain open for expansion along strike as well as to depth.”

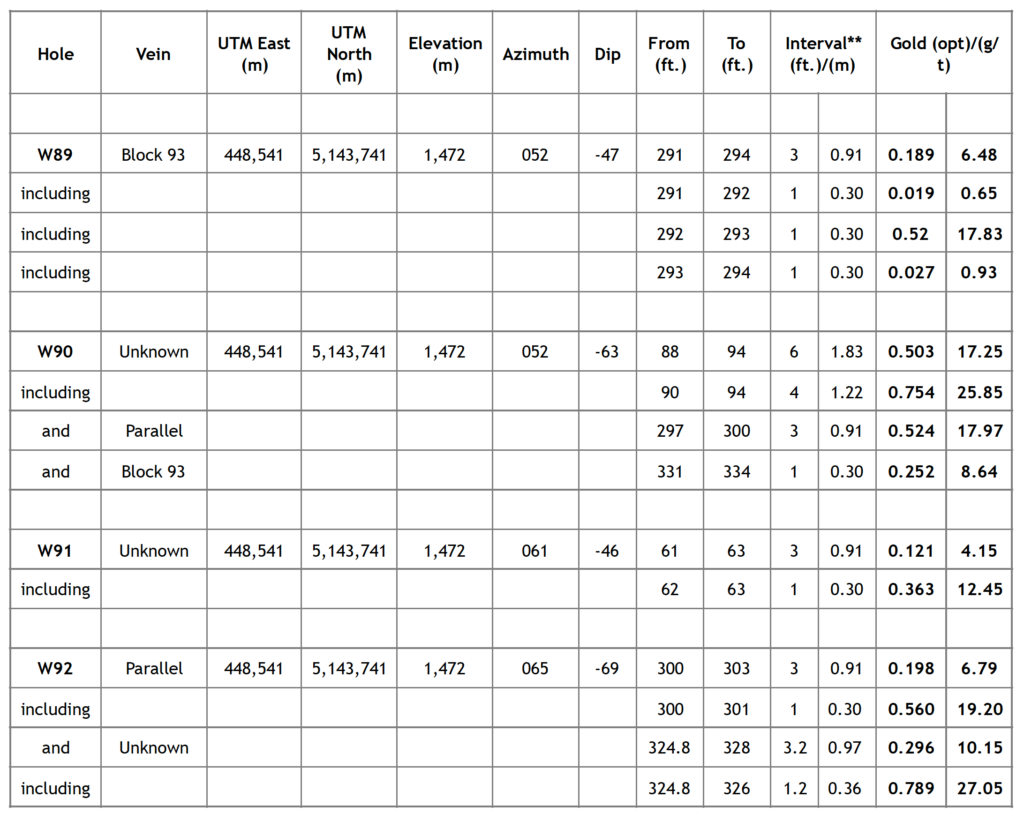

Due to the variable nature of the vein orientations, the true width of mineralization in the following drill intercepts is not known at this time.

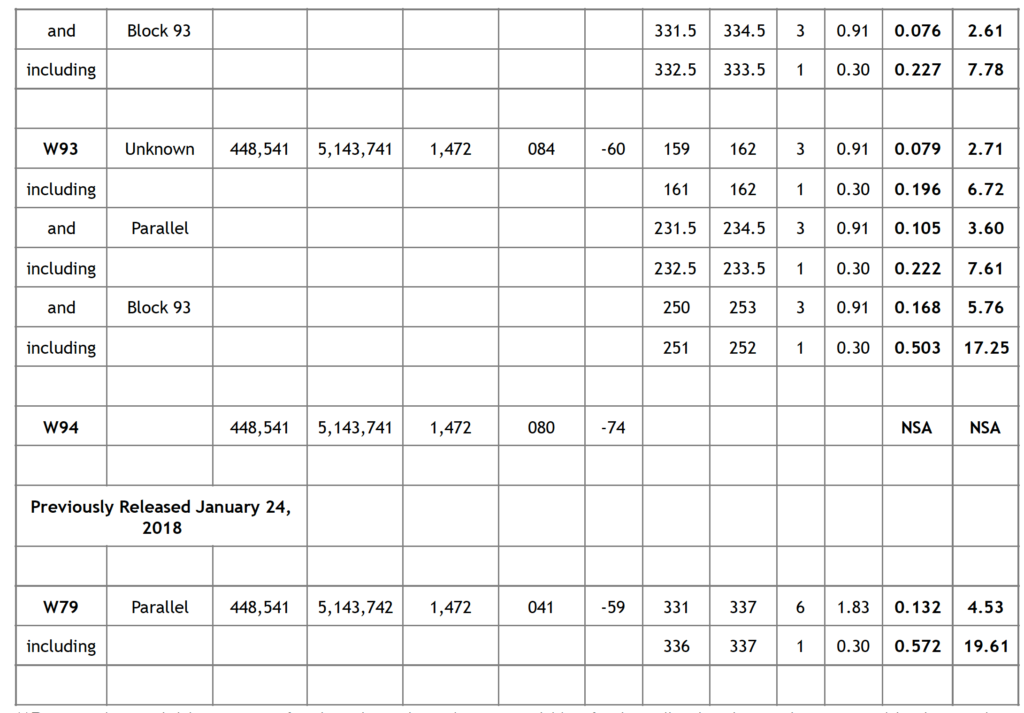

The recent drill program collared seven holes on the hanging wall side of both the Parallel and Block 93 veins with the goal of defining the Southwest extension of these veins. Previously reported hole, W79, (January 24th 2018 news release), intersected a barren structure where the Parallel vein was expected to be. Another 40 ft. (12.2 metres) further down-hole, the drill intersected mineralization over 6 ft. (1.83 m) averaging 0.132 ounce per ton (opt) gold (4.53 grams/tonne) including 1 ft. (0.30 m) that averaged 0.572 opt gold (19.61 g/t). This was listed as an unknown vein and is now re-interpreted to be the Block 93 vein.

Hole W89 was collared west of hole W79 and also intersected gold mineralization 40 ft. (12.2 m) further down-hole than expected. It cut 3 ft. (0.91 m) averaging 0.189 opt gold (6.48 g/t) at a down-hole depth of 291 ft. (88.7 m).

Since both intercepts intersected a mineralized vein 40 ft. (12.2 m) deeper than expected, Winston geologists assumed that a fault had offset both the Parallel and Block 93 veins. This was confirmed when hole W90 intersected both veins. Please refer to attached drill plan map.

Hole W90 intersected 3 ft. (0.91 m) averaging 0.524 opt gold (17.97 g/t) representing the Parallel vein and 1 ft. (0.30 m) averaging 0.252 opt gold (8.64 g/t), representing the Block 93 vein. Interestingly, W90 also intersected two previously unknown closely spaced veins in the hanging wall of the Parallel vein (above the Parallel vein). Including wall rock dilution these two veins averaged 0.503 opt gold (17.25 g/t) over 6 ft. (1.83 m).

Hole W91 intersected an unknown vein at a depth of 62 ft. (18.9 m) down-hole which averaged 0.363 opt gold (12.45 g/t) over 1 ft. (0.30 m).

Hole W92 intersected the Parallel vein which averaged 0.56 opt gold (19.20 g/t) over 1 ft. (0.30 m) Another unknown vein was intersected in between the Parallel and Block 93 veins that averaged 0.789 opt gold (27.05 g/t) over 1.2 ft. (0.36 m). The Block 93 vein was cut at a depth of 332.5 ft. (101.3 m) down-hole and averaged 0.227 opt gold (7.78 g/t) and 7.40 opt (253.71 g/t) silver over 1 ft. (0.30 m).

Hole W93 intersected an unknown vein in the hanging wall of the Parallel vein averaging 0.196 opt gold (6.72 g/t) over 1 ft. (0.30 m). Hole W93 also intersected both target veins. The Parallel vein averaged 0.222 opt gold (7.61 g/t) over 1 ft. (0.30 m) and the block 93 vein averaged 0.503 opt gold (17.25 g/t) over 1 ft. (0.30 m).

Hole W94 returned no significant assays and assays are still pending for hole W95.

Highlights of significant results are outlined in the table below.

**Due to the variable nature of vein orientation, the true width of mineralization is not known at this time unless specifically stated.

* NSA – No Significant Assays

Updated Drill Plan Map

The Winston Gold Project is central to a historic precious and base metal mining district in which most of the ore was mined from tightly structurally controlled high angle fissure veins and lode/replacement zones. Reports indicate that more than 100,000 ounces of gold was recovered from these underground mines in the late 19th to early 20th century from about 150,000 tons of ore. (Earle, 1964; Schell, 1963).

Sampling Methodology, Chain of Custody, Quality Control and Quality Assurance

All sampling was conducted under the supervision of the Company's project geologists and the chain of custody from the drill to the on-site sample preparation facility was continuously monitored. The samples are crushed, pulverized and the sample pulps digested and analyzed for gold in the Company’s on-site Assay Lab using fire assay fusion and a 50 gram gravimetric finish. Blank or certified reference materials are inserted randomly. Check Assays are sent to Bureau Veritas Minerals, in Reno Nevada.

Qualified Person

The scientific and technical content and interpretations contained in this news release have been reviewed, verified and approved by Dr. Criss Capps PhD. P.Geol., an independent consultant to Winston Gold Corp. Dr. Capps is a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Winston Gold

Winston Gold is a junior mining company focused on advancing high-grade, low cost mining opportunities into production. Towards that end, the Corporation has acquired an under-explored and under-exploited gold/silver mining opportunity known as the Winston Gold project near Helena, Montana.

On behalf of the Board of Directors of the Company and for further information, please contact:

Murray Nye, Chief Executive Officer and a director of Winston Gold, at:

Suite 201-919 Notre Dame Avenue

Winnipeg, Manitoba, R3E 0M8

Telephone: (204) 989-2434

E-mail: murray@winstongold.com

The CSE has neither approved nor disapproved the information contained herein.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Forward-Looking Information

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address events or developments that Winston Gold Mining Corp. (the "Company") expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include regulatory actions, market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.